Equipment Financing

For companies with capex requirements. Just-in-time financing. Flexible equipment lines that grow with business. Hardware-as-a-service. Additional capital incremental to existing debt.

What is Equipment

Financing?

This financing option originated to allow revenue-ramping start-ups to acquire capital-intensive operating equipment while preserving equity and reducing the overall cost of capital.

Raise up to $100M of equipment capital

access to just-in-time financing

incremental to your existing equity and debt facility

finance previously purchased assets

Entrepreneurs can maximize their enterprise value with equipment financing by extending their runway with a meaningful amount of non-dilutive capital. This kind of facility is only covered by the financed equipment, which gives the company flexibility on raising additional debt to further grow the business.

This financing option originated to allow revenue-ramping start-ups to acquire capital-intensive operating equipment while preserving equity and reducing the overall cost of capital.

Entrepreneurs can maximize their enterprise value with equipment financing by extending their runway with a meaningful amount of non-dilutive capital. This kind of facility is only covered by the financed equipment, which gives the company flexibility on raising additional debt to further grow the business.

Raise up to $100M of equipment capital

access to just-in-time financing

incremental to your existing equity and debt facility

finance previously purchased assets

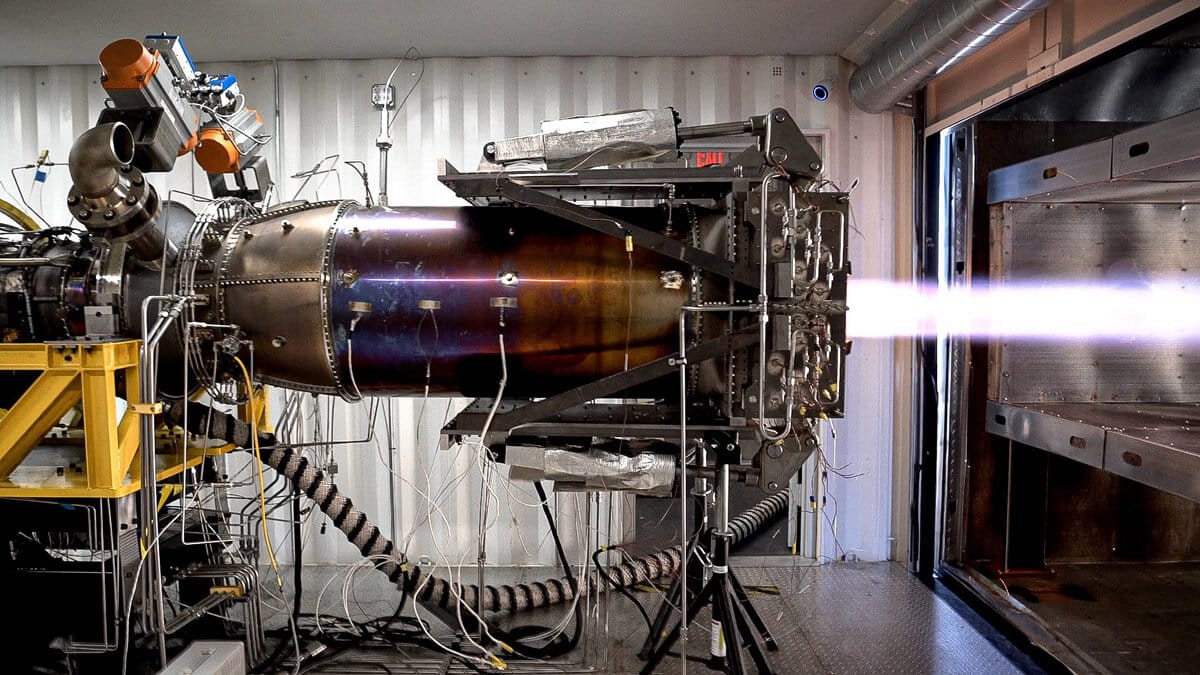

Hermeus’s Chimera Engine

Equipment financing is a focused piece of financing that is applicable to asset-heavy companies that want to be able to draw on the equipment line as they grow and scale their business.

Different types of equipment includes essentials like manufacturing and production equipment, robotics, test equipment, laboratory equipment, hardware-as-a-service, and other equipment that helps a company ramp up operations and achieve its next milestone.

Hermeus’s Chimera Engine

Benefits of Equipment Financing

Equipment financing increases working capital, and cash runway, and reduces equity dilution for businesses that require essential equipment and have large capex needs to scale operations.

Just In Time

Draw down the funds when you need them

Runway Extension

Lengthens cash runway, incremental to equity and debt financing

Focused Financing

Equipment specific lien does not impact the credit position of other lenders

Hardware-as-Service

Financing revenue generating equipment that can be highly customized

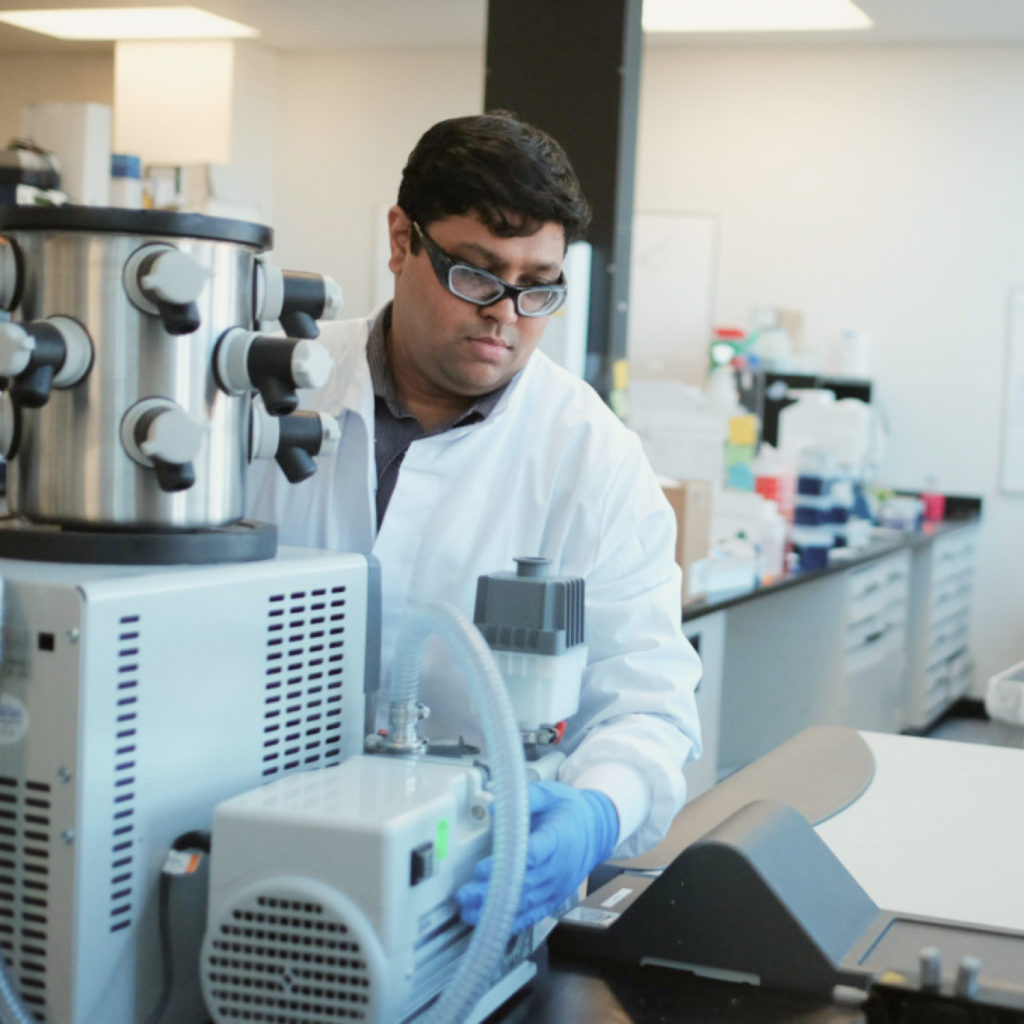

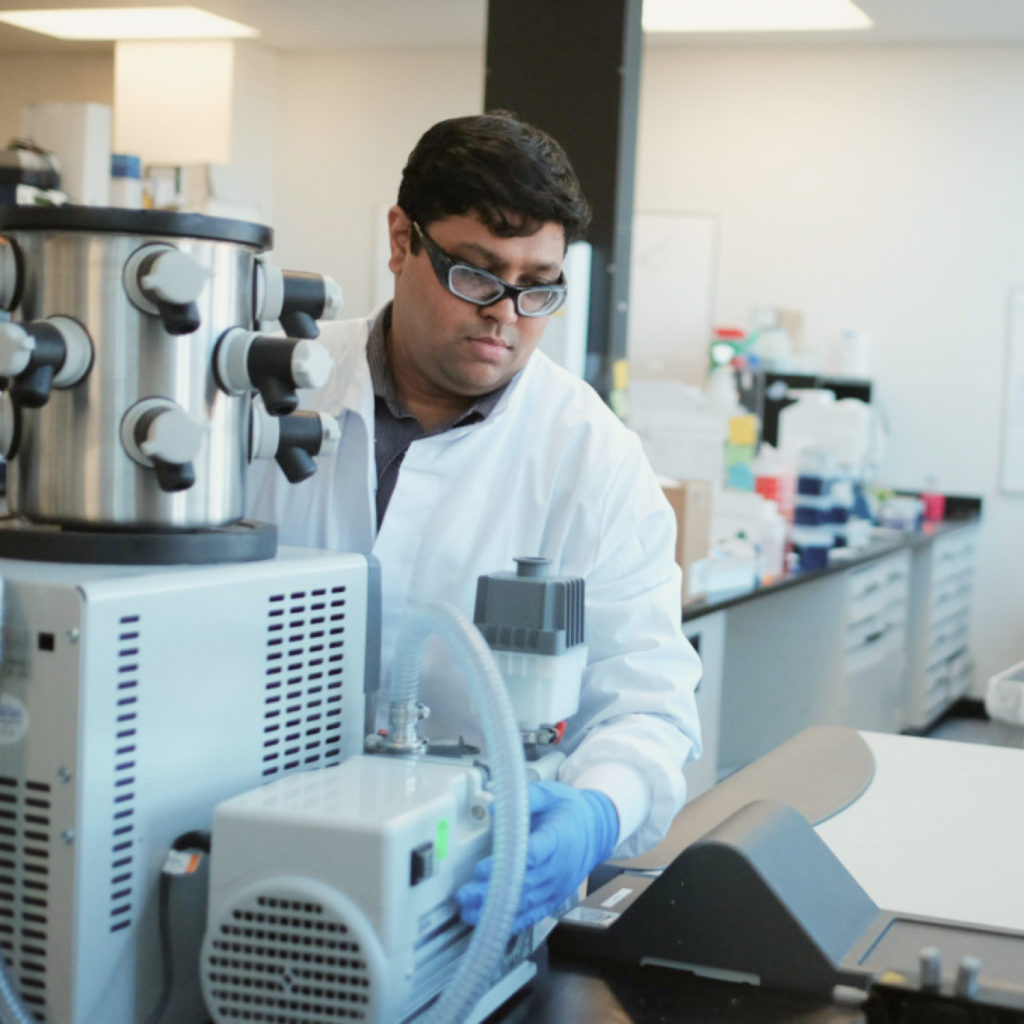

A scientist works in a lab at Greenlight Biosciences

Industries We’re Involved In

Certain industries are more capital-intensive than others. We’re excited to have partnered with a wide range of industries.

A scientist works in a lab at Greenlight Biosciences

Aerospace

Agricultural Equipment

Alternative Protein

Clean Technology

Energy

Food and Beverage / CPG

Information Technology

Life Sciences

Oil and Gas

Robotics

Semiconductors

Transportation

“ From space exploration to understanding atomic interactions, hardware is at the heart of some of the most amazing technologies and companies in the world. ”

Ryan Little

Senior Managing Director, Equipment Financing